2022

Revenue Ordinance

Chatham County

Georgia

Chatham County, Georgia

Revenue Ordinance

2022

Published by:

Chatham County Board of Commissioners

P.O. Box 9297

Savannah, Georgia 31412

Chatham County

Board of Commissioners

2021 – 2024

Commissioners:

Chester A. Ellis - Chairman

Kenneth A. Adams - District 8, Vice Chairman

Helen L. Stone - District 1, Chairman Pro Tem

Larry “Gator” Rivers - District 2

Bobby Lockett - District 3

Patrick K. Farrell - District 4

Tanya Milton - District 5

Aaron Whitely - District 6

Dean Kicklighter - District 7

Lee Smith - County Manager

Michael A. Kaigler - Asst. County Manager

Linda B. Cramer - Asst. County Manager

R. Jonathan Hart - County Attorney

Andre Pretorius - Asst. County Attorney

Reginald C. Martin - Asst. County Attorney

Janice E. Bocook - County Clerk

Compiled by:

Amy J. Davis - Finance Director

Estelle Brown - Budget Officer

Table of Contents

Article A. General

Section 1 Taxes .............................................................................................................. 1

Section 2 Service Charges & Fees ................................................................................. 1

Section 3 January 1 Governs For Year ........................................................................... 1

Section 4 Payment Requirements .................................................................................. 1

Section 5 Specific Requirements of Ordinance Govern .................................................. 1

Article B. Property Taxes

Section 1 Levy of Tax ..................................................................................................... 2

Section 2 Assessment of Property .................................................................................. 2

Section 3 Tax Rate ......................................................................................................... 2

Section 4 Payment Due Dates ....................................................................................... 2

Section 5 Penalty and Interest for Delinquent Payment ................................................. 2

Section 6 Return to County Assessor Required ............................................................ 3

Section 7 Public Utility Property Tax .............................................................................. 3

Section 8 List of Properties Required Under Certain Conditions ................................... 3

Article C. Financial Institutions Tax

Section 1 Financial Institutions Business Tax ................................................................ 4

Article D. Sales and Use Tax

Section 1 Levy of Tax .................................................................................................... 4

Section 2 Tax Rate, Base, Distribution and Fees .......................................................... 4

Article E. Excise Taxes

Section 1 Alcoholic Beverages ...................................................................................... 5

Section 2 Energy Excise Tax ......................................................................................... 5

Article F. Hotel / Motel Tax

Section 1 Hotel/Motel Tax .............................................................................................. 5

Article G. Tax on Professions

Section 1 Tax on Professions ............................................................................................... 5

Article H. Tax on Insurance Premiums

Section 1 Premium Tax on Life Insurers .............................................................................. 5

Section 2 Premium Tax on All Other Insurers ...................................................................... 5

Section 3 Administrative Provision ...................................................................................... 5

Article I. Public Utility Taxes

Part 1 - Cable Television Franchise Fee

Section 1 License Required; Application; Issuance .............................................................. 5

Section 2 Performance Bond ................................................................................................ 6

Section 3 Initial Franchise Fee & Subsequent Annual Gross Income

Payments Required .............................................................................................. 6

Part 2 – E911 Emergency Telephone Service Fee

Section 1 Levy of Fee .......................................................................................................... 6

Section 2 Rate…. ................................................................................................................ 6

Section 3 Collection of Fee .................................................................................................. 7

Section 4 Remittance to the State of Georgia ..................................................................... 7

Section 5 Administrative Fee ............................................................................................... 7

Section 6 Exemption From Fee ........................................................................................... 7

Section 7 Conditions and Use of Revenues ........................................................................ 7

Section 8 Prepaid Wireless Service Fee .............................................................................. 7

Article J. Court System of Chatham County

Section 1 Function of Courts .............................................................................................. 8

Section 2 Jail Construction and Staffing Act ....................................................................... 8

Section 3 County Drug Abuse Treatment & Education Fund .............................................. 8

Section 4 Peace Officer Annuity & Benefit Fund ................................................................ 9

Section 5 Victim Assistance Fines ...................................................................................... 9

Section 6 Public Defender Fees ......................................................................................... 9

Section 7 Judges of the Probate Courts Retirement Fund of Georgia ................................ 9

Section 8 Superior Court .................................................................................................... 9

Section 9 State Court........................................................................................................ 10

Section 10 Probate Court ................................................................................................... 10

Section 11 Magistrate Court ............................................................................................... 10

Section 12 Juvenile Court ................................................................................................... 10

Section 13 Recorders Court ............................................................................................... 10

Article K. Reimbursements

Section 1 County Reimbursements .................................................................................. 10

Article L. Land Bank Authority

Section 1 Surplus Property Account ................................................................................. 11

Article M. Voter / Election Revenues

Section 1 Fee Established ................................................................................................ 12

Section 2 Candidate Qualifying Fees................................................................................ 12

Section 3 Sale of Voter List .............................................................................................. 12

Article N. Rental Revenue

Section 1 Rental of County Facilities .......................................................................... 13

Article O. Other Revenue

Section 1 Payroll Garnishments ................................................................................ 13

Section 2 Health Inspections ..................................................................................... 13

Section 3 CSRU Application Fee .............................................................................. 13

Section 4 Sale of Surplus Property ........................................................................... 13

Section 5 Miscellaneous Revenue ............................................................................ 13

Section 6 Wireless Telecommunication Facilities Filing Fees ................................... 14

Section 7 Secondary Metal Recycling Program ........................................................ 15

Section 8 CCPD and Sheriff Off Duty Program ......................................................... 15

Section 9 Short Term Rental Licensing Fee……………………………………………..15

Article P. Parking Garage Fees

Section 1 Parking Fees ............................................................................................ 15

Article Q. Police Administrative Fees

Section 1 Crime Scene Report ................................................................................. 16

Section 2 Fingerprinting Fee .................................................................................... 16

Section 3 Accident Report Fee ................................................................................ 16

Section 4 Parking Citation ........................................................................................ 16

Section 5 Video / Audio Tapes Copying Fee ............................................................ 17

Section 6 Photo Copying & Enlargement Fee .......................................................... 17

Section 7 Records Unit Fees ................................................................................... 17

Section 8 Animal Control Fees ................................................................................. 17

Section 9 Confiscated Funds ................................................................................... 20

Section10 False Alarms .............................. ……………………………………………..20

Section 11 Automated Traffic Enforcement Safety Devices in School

Zones… .................................................................................... ……..22

Article R. Engineering Fees

Section 1 Land Disturbing Activity Fees .................................................................. 22

Section 2 Other Engineering Fees ........................................................................... 23

Article S. Recreation Facilities & Program Fees

Section 1 Recreational Facilities .............................................................................. 23

Section 2 Recognized Community Ogranization………………………………………..24

Section 3 Participating Club…………………………………………………………….…24

Article T. Inspection Fees

Section 1 Building Inspection Fees .......................................................................... 24

Section 2 Electrical Inspection Fees ........................................................................ 25

Section 3 Mechanical Inspection Fees ..................................................................... 25

Section 4 Plumbing Inspection Fees ........................................................................ 25

Section 5 Safety Inspection Fees ............................................................................. 25

Section 6 Manufactured Homes ............................................................................... 26

Section 7 Docks ....................................................................................................... 26

Section 8 Signs ........................................................................................................ 26

Section 9 Moving of Buildings or Structures ............................................................. 26

Section 10 Demolition of Buildings or Structures ....................................................... 26

Section 11 Well Installation ........................................................................................ 26

Section 12 Air Curtain Destructor ............................................................................... 26

Section 13 Landfills, Mining & Ponds .......................................................................... 26

Section 14 Fuel Storage Tanks ................................................................................... 26

Section 15 Pools……………… .................................................................................... 27

Section 16 Fences........................................................................................................27

Section 17 Hazardous Substance Registration Fee……………………………………..27

Article U. Appeals, Rezoning, Development and Review Fees

Section 1 Zoning appeals ……...…………………………………………………………...27

Section 2 Map Amendments ...................................................................................... 27

Section 3 Text Amendments ...................................................................................... 27

Section 4 Board of Appeals........................................................................................ 28

Section 5 Deferrals .................................................................................................... 28

Section 6 Subdivisions ............................................................................................... 28

Section 7 Historic Review Filing Fees ........................................................................ 29

Article V. Solid Waste Operations

Section 1 Solid Waste Management Activity Fee ....................................................... 30

Section 2 Solid Waste Fees............................................. ...................................... ....31

Article W. Sewer Service Charges & Fees

Section 1 Application for Sewer Services .................................................................. 31

Section 2 Sewer Service Fees .................................................................................. 31

Section 3 Tap-In Fees ............................................................................................... 31

Article X. Public Works

Section 1 Rights-Of-Way Encroachment Permit ....................................................... 31

Section 2 Penalty Fee ............................................................................................... 32

Section 3 Additional Details ...................................................................................... 32

Article Y. Street Paving

Section 1 Citizen Participation Paving ...................................................................... 32

Article Z. Street Lighting

Section 1 Street Lighting Rates ................................................................................ 32

Article AA. Abandoned Motor Vehicles

Section 1 Definition .................................................................................................. 33

Section 2 Decal Required ........................................................................................ 33

Section 3 Registration .............................................................................................. 33

Article BB. Alcoholic Beverage Licenses

Section 1 Alcoholic Beverages Licenses.................................................................. 33

Article CC. Business / Occupational Tax

Section 1 Business/Occupational Tax ..................................................................... 33

Article DD. Fire Protection Service Fee ……………………………………………………………………….33

Article EE. Amendment, Severability, Repealer and Effective Date

Section 1 Subsequent Amendment ......................................................................... 33

Section 2 Effect Upon Previous Ordinances ........................................................... 33

Section 3 Severability ............................................................................................. 34

Section 4 Repealer ................................................................................................. 34

Section 5 Effective Date of Ordinance .................................................................... 34

Appendix A Recorder’s Court Fees ...................................................................................................... 35

Appendix B Recreation Fees ............................................................................................................... 50

Appendix C Energy Excise Tax Ordinance............................................................................................. 58

- 1 -

Revenue Ordinance

Purpose: An ordinance to assess and levy taxes, service charges and fees for the purpose of raising revenue for

Chatham County; to repeal all ordinances and parts of ordinances in conflict herewith; to establish an effective date;

and, for other purposes connected with revenue in said County.

Article A. General

Section 1 Taxes

Beginning January 1, and thereafter, the inhabitants within the corporate and jurisdictional limits of

Chatham County, and those who hold taxable property within the said County, and those who

transact or offer to transact business therein, and those who practice the professions therein, except

such as are exempt from taxation by law, shall pay toward the support of the government of Chatham

County, the taxes herein prescribed.

Section 2 Service Charges and Fees

The inhabitants of Chatham County who are subject to certain service charges and fees shall pay

such charges and fees as herein prescribed.

Section 3 January 1 Governs For Year

All taxes which are required for real and personal property held on the first day of January, and for

any business and profession, in which any person may be engaged on that date, shall be considered

due and payable for the entire year.

Section 4 Payment Requirements

Any tax, license fee, service fee or any other revenue due under this ordinance shall be due and

payable to Chatham County. All payments shall be made in lawful funds of the United States of

America, provided that Chatham County may require coins to be wrapped in authentic bank coin

tubes or wrappers if the amounts of such coins equal or exceed fifty cents ($.50) in pennies, two

dollars ($2.00) in nickels, five dollars ($5.00) in dimes or ten dollars ($10.00) in quarters. A returned

check fee of $30.00 is authorized.

Section 5 Specific Requirements of Ordinance Govern

In the event that any general requirement of this ordinance shall be or shall appear to be in conflict

with a specific requirement hereof, the specific requirement as related to the subject at hand shall

govern.

- 2 -

Article B. Property Taxes

Section 1 Levy of Tax

Each person, firm, and corporation owning real property, including improvements, in Chatham

County on the first day of January, and each person, firm, and corporation owning or holding in trust

or consignment, furniture, fixtures, machinery and equipment, merchandise inventories, boats and

boat motors, automobiles and other vehicular equipment, aircraft, mobile homes, and every other

kind of personal property in Chatham County on the first day of January, shall pay a tax upon such

property to the Chatham County Tax Commissioner, except upon household goods, personal tools,

and other such property as may be exempt from taxation under the laws of this State.

Section 2 Assessment of Property

Such tax on real and personal property shall be based upon the assessed value thereof as lawfully

determined by the Chatham County Board of Assessors pursuant to O.C.G.A 48-5-2 and 48-5-7.

Section 3 Tax Rate

The County-wide tax rate on real and personal property, calculated pursuant to O.C.G.A. 48-5-560,

et seq., shall be 11.543 mills for 2021. The final rate adopted and levied for 2022 shall be 10.518

mills on the dollar (.010518) or $10.518 per $1,000.00 in assessed value. In addition, a rate of 4.502

mills on the dollar (.004502 or $4.502 per $1,000.00 in assessed value for Special Service District

and 1.056 mill on the dollar (.001056) or $1.056 per $1,000.00 in assessed value for Chatham Area

Transit District shall be levied in 2022. The recommended 2022 millage levy by State law cannot be

adopted until the digest is approved in late summer of 2022.

Section 4 Payment Due Dates

a. Real Property - Any tax levied on real property shall be payable in semiannual installments

to the Chatham County Tax Commissioner. The first installment shall be due on or before

June 1

st

of each year and the second installment shall be due on or before November 15

th

of

each year.

b. Personal Property - Any tax upon personal property is billed annually and is due on

November 15

th

of each year to the Chatham County Tax Commissioner.

c. Adjustment of Due Dates - Nothing contained herein shall be construed as prohibiting

adjustment or modification of said due dates nor elimination of the first installment billing

should conditions so warrant.

Section 5 Penalty and Interest for Delinquent Payment

Prior to July 1, 2016

In the event that any tax is not paid when the same is due on or before June 30, 2016, the outstanding

amount shall bear interest at the rate of one percent (1%) per month from the date the tax is due

until the date the tax is paid through June 30, 2016. Any period of less than one month shall be

considered to be one month.

In any instance in which any person willfully fails to pay when the same is due on or before June 30,

- 3 -

2016, within ninety (90) days of the date when due, any ad valorem tax, except where the tax is

$500.00 or less on homestead property as defined in O.C.G.A. 48-5-2, the tax payer shall pay, in the

absence of a specific statutory civil penalty for the failure, a penalty of ten percent (10%) of the

amount of tax due and not paid on, or before the time prescribed by law, together with interest as

specified by law.

Effective July 1, 2016

In the event that any tax is not paid when the same is due on or after July 01, 2016, the outstanding

amount shall bear interest at the rate of equal to the bank prime loan rate posted by the Board of

Governors of the Federal Reserve System under statistical release H.15 + 3% to accrue monthly

from the date the tax is due until the tax is paid. Any period of less than one month shall be considered

to be one month.

In any instance in which any person willfully fails to pay when the same is due on or after July 01,

2016:

1. Within 120 days after the due date, the first penalty of 5% of the amount of taxes due and unpaid

is assessed.

2. After 120 days of the date of imposition of the first penalty, a second penalty of 5% of any amount

of taxes remaining due is imposed.

3. After 120 days of the date of imposition of the second penalty, a third penalty in the amount of

5% of the remaining taxes would be imposed.

4. After 120 days of the date of imposition of the third penalty of 5% of the remaining taxes due, a

fourth penalty of 5% of the remaining taxes due can be imposed. At no time can the total penalty

exceed 20%.

Ad Valorem taxes on motor vehicles, mobile homes, timber and heavy duty equipment are subject

to penalty under O.C.G.A. 48-5-51 which states the penalty shall be 10% of the tax due or $5.00

whichever is greater, together with interest at the rate of 1% per month. Any period of less than one

month shall be considered to be one month.

Section 6 Return to County Assessor Required

Each person, firm, and corporation liable for real or personal property taxes under this ordinance

shall make a return to the office of the Chatham County Board of Assessors pursuant to O.C.G.A.

48-5-10.

Section 7 Public Utility Property Tax

Any person or firm required to pay a public utility property tax or any other tax based upon an

assessment value made through the Georgia Department of Revenue shall pay to the Chatham

County Tax Commissioner. Each bill will show the applicable due date. In the event the tax is not

paid when due, interest will accrue based on O.C.G.A. 48-2-40 and penalty will be applied based on

O.C.G.A. 48-2-44.

Section 8 Lists of Properties Required Under Certain Conditions

For the purpose of enabling the Board of Assessors to obtain full and complete information with

reference to location and ownership of personal property in Chatham County which may be subject

to taxation, each person, firm, or corporation conducting a rental agency in Chatham County for the

- 4 -

purpose of renting furnished rooms, apartments, houses and flats, is hereby required to furnish, upon

demand by said Board, a written list of all such furnished rooms, houses, apartments, and flats,

together with the names, location, and mailing addresses of the owners thereof. Each person, firm,

or corporation owning and operating a storage warehouse in Chatham County is hereby required to

furnish, upon demand, a written list of all person, firms, and corporation who may have on storage in

said warehouse any stock of merchandise or machinery of any kind, or furniture and household

goods, or any other personal property of any nature, together with the address and location of the

owners thereof.

Article C. Financial Institutions Tax

Section 1 Financial Institutions Business License Tax

Refer to Chatham County Code Chapter 16 Article IX Financial Institutions Tax.

https://www.chathamcountyga.gov/OurCounty/CodeBook.

https://www.chathamcountyga.gov/OurCounty/CodeBook

Article D. Sales and Use Tax

Section 1 Levy of Tax

Pursuant to the Official Code of Georgia Annotated (O.C.G.A.) 48-8, Article 2, encompassing

sections 48-8-80 1975, the Chatham County Commissioners by resolution adopted on October 3,

1975, and levied the local option sales and use tax for unincorporated Chatham County and for all

municipalities within Chatham County. The tax became effective on April 1, 1976.

Pursuant to O.C.G.A. 48-8-3, the Chatham County Commissioners approved a Resolution to extend

the Special Purpose Local Option Sales Tax. The referendum was held on August 23, 2013, for

2014-2020.

Section 2 Tax Rate, Base, Distribution and Fees

a. Rate and Base - The local option sales and use tax rate is one percent (1%) of the monetary

value of all retail sales of goods and services within Chatham County. The special purpose

local option sales tax is one percent (1%) of the monetary value of all retail sales of goods

and services within Chatham County.

b. Collection and Distribution - Sales and use tax revenues are collected by the State

Department of Revenue, Sales and Use Tax Division, and distributed to general purpose

local governments within Chatham County in accordance with a distribution formula adopted

by the participating governments within the County.

c. Collection of Fees - Retail merchants are allowed a commission of three percent (3%) of the

taxes collected as a deduction in the amount paid to the State Department of Revenue, and

the State Department of Revenue deducts one percent (1%) of the tax proceeds to defray

State handling costs.

Article E. Excise Taxes

Section 1 Alcoholic Beverages

Refer to Chatham County Code Chapter 17 Alcoholic Beverage Ordinance.

https://www.chathamcountyga.gov/OurCounty/CodeBook

- 5 -

Section 2 Energy Excise Tax

Effective January 1, 2013, the County Board of Commissioners implemented an Energy Excise Tax.

See Appendix G – Ordinance Imposing an Excise Tax on the Sale, Use, Storage, or Consumption

of Energy.

Article F. Hotel / Motel Tax

Section 1 Hotel / Motel Tax

Refer to Chatham County Code Chapter 16 Article IV Hotel/Motel Tax.

https://www.chathamcountyga.gov/OurCounty/CodeBook

Article G. Tax on Professions

Section 1 Tax on Professions

Refer to Chatham County Code Chapter 16 Article 1 16-105 (2) Occupational Tax on Professions.

https://www.chathamcountyga.gov/OurCounty/CodeBook

Article H. Tax on Insurance Premiums

Section 1 Premium Tax on Life Insurers

There is hereby levied an annual tax, based solely upon gross direct premiums upon each insurer

writing life, accident and sickness insurance within Chatham County. This tax is in an amount equal

to one percent (1%) of the gross direct premiums received during the preceding calendar year in

accordance with O.C.G.A., 33-8-4. The tax levied here is in addition to the license fees imposed by

this ordinance.

Section 2 Premium Tax on All Other Insurers

There is hereby levied an annual tax upon each insurer, other than an insurer transacting business

in the insurance class designated in subsection 1 of O.C.G.A., 33-3-5, doing business within the

County. The tax shall be in an amount equal to two and one-half percent (2.5%) of the gross direct

premiums received during the preceding calendar year. Gross direct premiums as used in this

section shall mean gross direct premiums as defined in O.C.G.A. 33-8-2 (a).

Section 3 Administrative Provision

The Clerk of Commission is hereby directed to send a certified copy of this Article to the Georgia

Insurance Commissioner.

Article I. Public Utility Taxes - Part 1. Cable Television Franchise Fee

Section 1 License Required; Application; Issuance

Before any person, firm or corporation shall be allowed to proceed with the installation of its

community antenna television system hereunder, it shall first file an application for such franchise

with the County or with the State of Georgia. If the applicant files with the County, the following is

required - applicant’s name and address; the date and place of incorporation if applicant is

incorporated; a list of names and addresses of stockholders, directors and officers of applicants if

incorporated; the most recent certified balance sheet of corporation or partnership or a sworn

statement of net worth if applicant is an individual; location of all other CATV operations of applicant;

the means of erecting wires contemplated by applicant; section or sections of the County

- 6 -

contemplated where operation of franchise will be begun by applicant; attached policy or

certifications of insurance showing worker’s compensation, liability and indemnification as prescribed

by this Ordinance; and attached certified check in the amount of One Thousand Dollars ($1,000.00)

for applicants with less than one hundred (100) subscribers or Ten Dollars ($10.00) per subscriber

for applicants with more than one hundred (100) subscribers, payable to Chatham County, which

check shall be returned to an unsuccessful applicant or applied toward payment of the initial franchise

fee for a successful applicant, agreement to fully perform the contract and upon a determination of

a failure to do so, franchisee shall forfeit that portion of the fee that has been applied toward the

payment of the initial franchise fee; an agreement to comply with and be bound by all ordinances of

the County together with an agreement to be bound by all future ordinances regulating CATV in the

County and otherwise as pertains to a renewed franchise; and, such other information as required

by the County Manager.

Section 2 Performance Bond

Prior to the granting of such franchise, applicant shall also file with the County a Performance Bond

if there will be construction within the County’s rights-of-way in the amount to be negotiated with

sufficient sureties, in favor of the County, conditioned on said franchisee’s faithful execution of the

obligations under this Ordinance.

Section 3 Initial Franchise Fee & Subsequent Annual Gross Revenue Payments Required

Each franchisee shall pay the initial franchise fee at the time it receives its license pursuant to this

Article. In consideration of permission to use the streets and public ways of the County for the

construction, operation, maintenance, and reconstruction of a cable system within the

unincorporated areas of the County, the franchisee shall pay to the County a quarterly franchise fee

of 5% of its annual gross revenue taken in and received by it from all of the unincorporated areas of

Chatham County during the preceding fiscal year. Gross Revenue is defined by O.C.G.A. 36-76-2.

Public Utility Taxes - Part 2. E-911 Emergency Telephone Service Fee

Section 1 Levy of Fee

Pursuant to O.C.G.A. 46-5-134, each county government in the State of Georgia is authorized to

levy and collect a fee for emergency 911 telephone service under certain conditions, and pursuant

to a resolution of the Chatham County Commission, an E-911 emergency telephone service fee is

levied with the County, to be effective April 1, 1992; effective December 1, 1999 for Wireless

telecommunications connections; and effective April 21, 2008 for Voice over Internet Protocol

(VOIP).

Section 2 Rate

a. The rate for E-911 emergency telephone service shall be One Dollar and Fifty Cents ($1.50)

per month per exchange access facility provided to each telephone subscriber within the

County.

b. Effective October 1, 2006, the rate for E-911 emergency telephone service shall be One

- 7 -

Dollar and Fifty cents ($1.50) per month per wireless telecommunication connection whose

billing address is in the County jurisdiction. Effective April 21, 2008, the rate for Voice over

Internet Protocol shall be One Dollar and Fifty Cents ($1.50).

Section 3 Collection of Fee

In accordance with the provisions of O.C.G.A. 46-5-134, each telephone service supplier within the

County shall, on behalf of Chatham County, bill and collect the E-911 fee from telephone subscribers

to whom it provides exchange telephone service in the area served by the E-911 system.

Section 4 Remittance to the State of Georgia

In accordance with the provisions of O.C.G.A 38-3-185, beginning January 1, 2019 all collections in

accordance with O.C.G.A. 46-5-133 and 46-5-134 shall be remitted to the State of Georgia using

Georgia Tax Center www.gtc.dor.ga.gov. Remittance is to be submitted no later than the 20

th

day

of the month following the month of collection.

Section 5 Administrative Fee

Each telephone service supplier that collects E-911 charges on behalf of the County is entitled to

retain as an administrative fee an amount equal to three percent (3%) of the gross E-911 income to

be remitted to the State of Georgia.

Section 6 Exemption From Fee

All exchange access facilities billed to the federal, state, or local governments shall be exempt from

the E-911 charge.

Section 7 Conditions and Use of Revenue

a. Pursuant to O.C.G.A. 46-5-134, paragraph (d) (2), all revenues from monthly E-911 charges

shall be deposited and accounted for in a separate restricted revenue fund known as the

Emergency Telephone System Fund. The County may invest the money in the fund in the

same manner that other monies of the County government may be invested and any income

earned from such investment shall be deposited into the Emergency Telephone System

Fund.

b. Pursuant to O.C.G.A. 46-5-134, paragraph (f), money from the Emergency Telephone

System Fund shall be used only to pay costs associated with providing E-911 telephone

service.

c. In accordance with O.C.G.A. 46-5-134 (e), a wireless service supplier may recover a

portion of its costs expended on the implementation and provision of wireless enhanced E-

911 services to subscribers.

Section 8 Prepaid Wireless Service Fee

In accordance with O.C.G.A. 46-5-134.2, as of January 1, 2019 prepaid wireless E-911 charges

shall be $1.50 per service. Sellers are required to remit collections of the charges to the State of

Georgia using the Georgia Tax Center at www.gtc.dor.ga.gov. Remittance is to be submitted no

- 8 -

later than the 20

th

day of the month following the month of collection. Sellers are permitted to retain

a 3% administration fee.

Article J. Court System of Chatham County

Section 1 Function of Courts

Under the Official Code of Georgia Annotated, the clerks of the courts shall pay into the County

treasury all monies arising from fines and forfeitures collected by them except as specified under

provisions of the Official Code of Georgia Annotated. Upon failure to do so, the clerks of the courts

shall be subject to rule and attachment as in the case of defaulting sheriffs. The monies arising from

fines and forfeitures shall be kept separate and distinct from County funds arising from other sources,

and shall also be kept by the County on the basis of the court from which the funds were received.

All courts are legally required to consider the below charges that will be remitted to Chatham County

when assessing fines and forfeitures.

Section 2 Jail Construction and Staffing Act

Authorized under provisions of the Constitution of Georgia, the collection of these revenues was

authorized by action of the Commissioners of Chatham County. This Act enables the courts to

impose additional penalty assessments in criminal and traffic cases, and cases involving violations

of County ordinances. The proceeds from the additional revenue are used to construct, operate,

and staff jails and penal institutions.

In cases in which a superior court, state court, probate court, magistrate court, municipal court, or

other court imposes a fine for any offense against a criminal or traffic law of Georgia or any ordinance

of Chatham County, the court charges an additional penalty of ten percent (10%) of the original fine.

Where bond is posted in any case involving a criminal or traffic law of Georgia or a County ordinance,

an additional ten percent (10%) of the original amount of bail or bond shall be posted. When the

court orders the forfeiture of the bail or bond, the additional ten percent (10%) shall be paid over to

the court.

The funds collected under the Jail Construction and Staffing Act are remitted monthly to Chatham

County where they are separately identified and used for constructing, operating, and staffing the

County’s jail and detention facility and for collateral applied to the payment of any bonds issued for

the construction of County penal institutions.

Section 3 County Drug Abuse Treatment & Education Fund

Under the Official Code of Georgia Annotated, the County imposes a penalty upon offenses related

to activities regarding marijuana, controlled substances, and non-controlled substances. The penalty

is fifty percent (50%) of the original fine.

Funds collected under this article are expended by the County for drug abuse treatment and

education programs related to controlled substances, and marijuana.

- 9 -

Section 4 Peace Officer Annuity & Benefit Fund

As authorized by the Official Code of Georgia Annotated, the County collects a portion of each fine

imposed and each bond forfeited in any criminal or quasi-criminal case for violation of State statutes

or County ordinances. The fees collected are:

$3.00 for any fine or bond forfeiture more than $4.00 but less than $25.00;

$4.00 for any fine or bond forfeiture more than $25.00 but less than $50.00;

$5.00 for any fine or bond forfeiture more than $50.00 but less than $100.00; and,

5% of any fine or bond forfeiture greater than $100.00.

The amount of the fine or bond forfeiture includes costs. Chatham County remits these fees monthly

to the Peace Officer Annuity and Benefit Fund.

Section 5 Victim Assistance Fines

Pursuant to O.C.G.A. 15-21-131, paragraph (a), all courts shall impose a fine, which shall be

construed to include costs, for any criminal offense, which will include an additional penalty equal to

five percent (5%) of the original fine for the purpose of assisting in funding of victim assistance

programs.

Section 6 Public Defender Fees

Pursuant to O.C.G.A. Chapter 12 of Title 17, Georgia law requires every person who applies for legal

defense services to pay the Public Defender Office a single fee of $50.00 for the application for,

receipt of, or application for and receipt of such services. Fees collected for felony cases will be sent

to the State of Georgia. Fees collected for misdemeanor cases will be distributed to Chatham

County.

Section 7 Judges of the Probate Courts Retirement Fund of Georgia

Pursuant to O.C.G.A. 47-11-50, twenty percent of all fees collected by any and all judges of the

probate courts for any service rendered as such in taking applications for marriage licenses,

issuing and recording such marriage licenses, and filing such applications and marriage licenses

with the Department of Community Health as well as $2 of each civil filing fee and $1 of the fee

;paid for each application for a licenses to carry a pistol or revolver or a renewal thereof.

Section 8 Superior Court

Superior Court Fees for services and filing fees are established by the legislature and detailed in

O.C.G.A. 15-6-77. Civil filing fees and criminal fines are all comprised of a base amount and up to

fifteen separate fees that are “add ons” or “take outs” of the original base amount. Each separate

fee is detailed in the Official Code of Georgia. The court also collects transfer taxes and intangible

taxes associated with real estate transactions. The fee schedule is shown on the Chatham County

website at https://superiorcourtclerk.chathamcountyga.gov.

Section 8 (A) The Superior Court Clerk’s Office has been designated as a Passport Acceptance

Facility of the Department of State for the purpose of accepting applications for passport. The Clerk

of Superior Court has been authorized by the State Department to receive facility acceptances fees

for services provided as a Passport Services Acceptance Facility. An execution fee of $35 and a

- 10 -

passport photo fee of $14 will be made payable to the Clerk of Superior Court . All other fees will be

made payable to the Department of State by the applicant. A list of United States Passport fees can

be found at https://superiorcourtclerk.chathamcountyga.gov.

Section 9 State Court

The most up-to-date schedule of fees for State Court can be found at

https://courts.chathamcountyga.gov/State/FeeSchedule/

Section 10 Probate Court

The Probate Court is entitled to recover costs for specific services under the Official Code of Georgia,

Annotated. The Court also collects a Weapons Carrying License (WCL) fee. The fee schedule is

shown on the Chatham County website at https://courts.chathamcountyga.gov/Probate/Fees.

Nothing in this provision shall be construed to conflict with the Section 7 herein.

Section 11 Magistrate Court

The Magistrate Court serves and tries claims on person/entities, and does not conduct jury trials.

Additional revenue is collected by criminal worthless check warrants through collection fines.

The fee schedule for Magistrate Court is shown on the Chatham County website at

https://courts.chathamcountyga.gov/Magistrate/Fees.

Section 12 Juvenile Court

The Juvenile Court can collect supervision fees from those placed under the court’s formal or informal

supervision. The court may use these fees to expand ancillary services authorized under the Georgia

law. The court may order fees as follows:

a. An initial court supervision user’s fee not less than ten dollars ($10.00) nor more than

two hundred dollars ($200.00); and,

b A court supervision users fee not less than two dollars ($2.00) nor more than thirty

dollars ($30.00) for each month the child receives supervision.

The child, each parent, guardian, or legal custodian of the child may be jointly and severally liable

for the payment of the fee and subject to law enforcement procedures. Supervision fees are remitted

to Chatham County monthly. The funds are used to provide supplemental community based services

to juvenile offenders.

In cases involving traffic offenses, the Juvenile Court Judges are authorized by statute, O.C.G.A. 15-

11-73 (g) (4) to order the child to pay a fine to the general fund of the county.

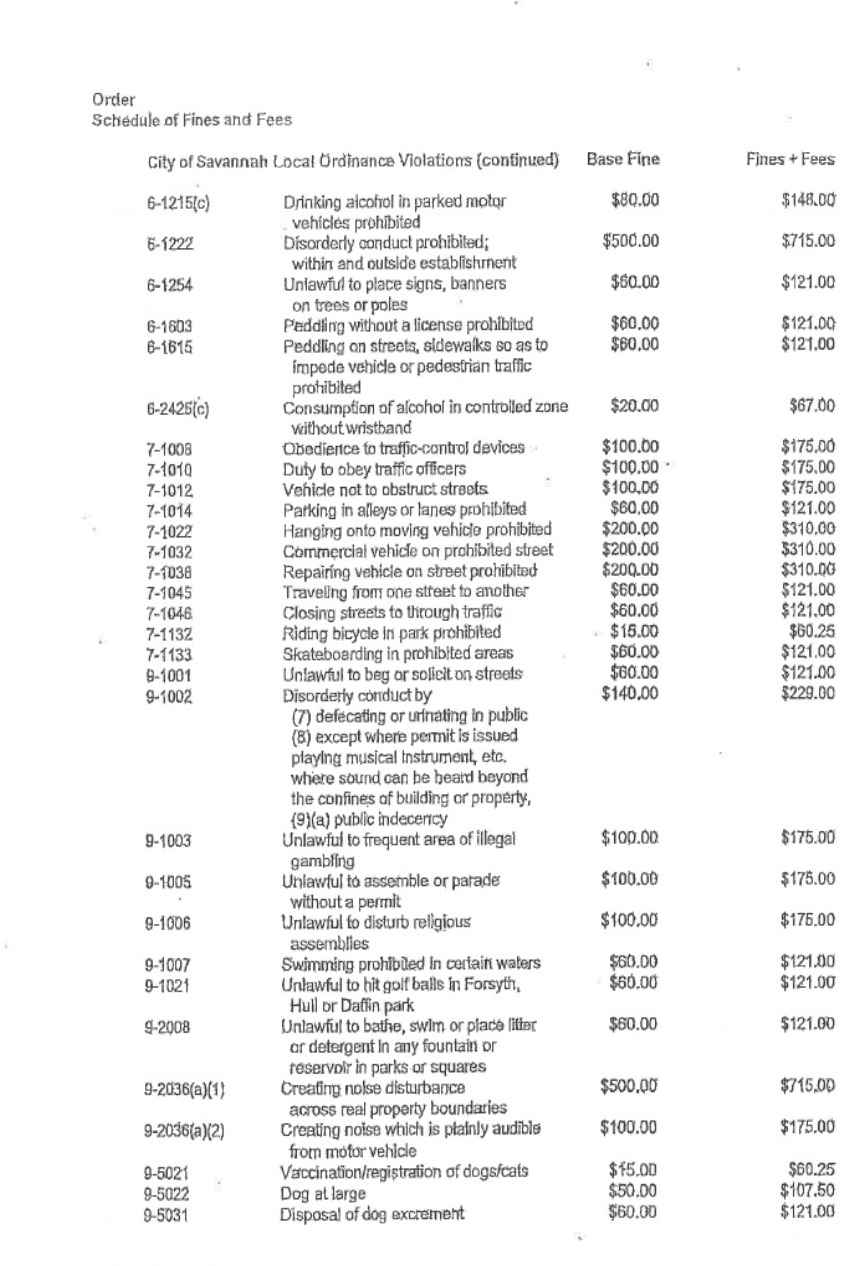

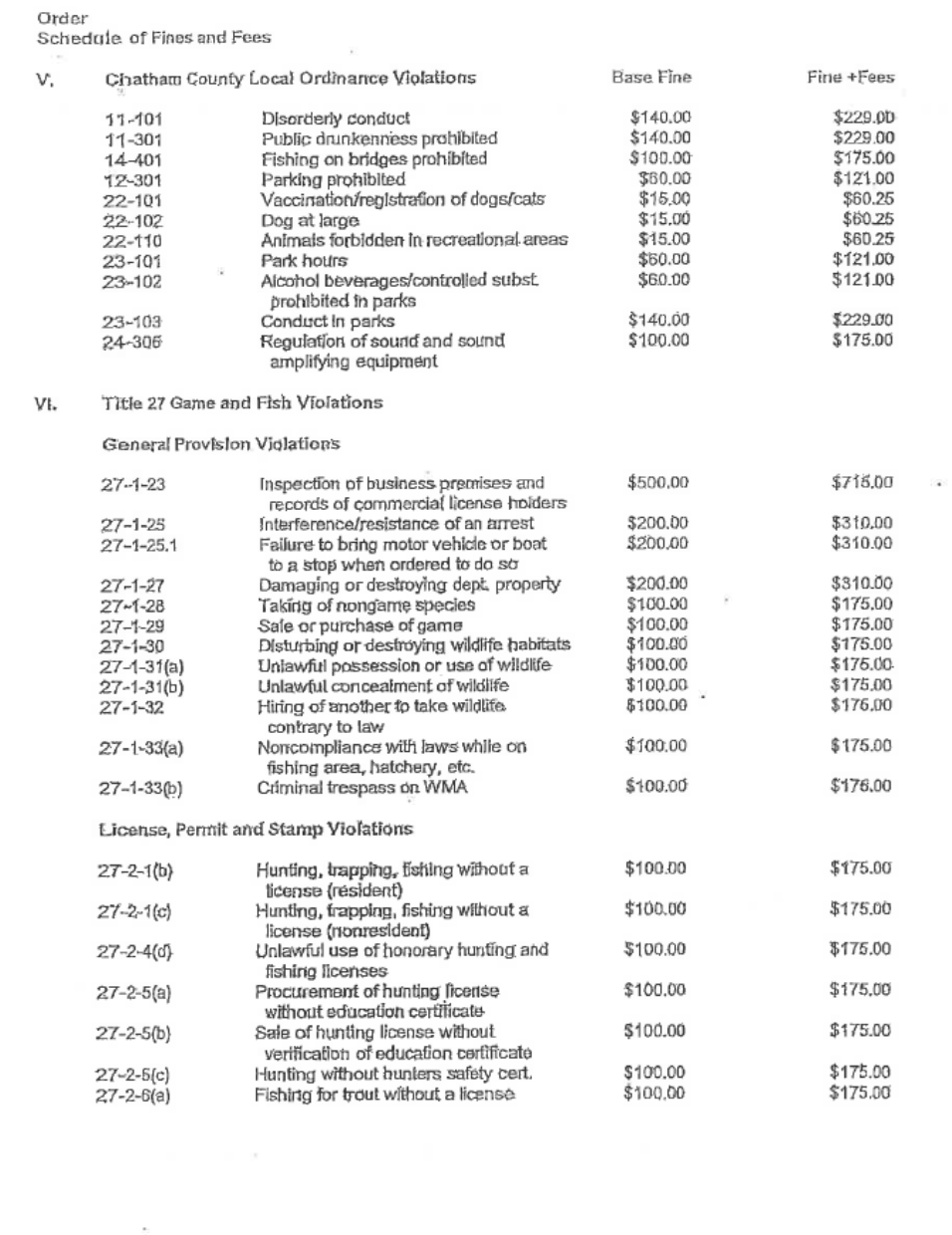

Section 13 Recorder’s Court

The Recorders Court operates under the City of Savannah. However, it collects revenue for

Chatham County on cases involving County jurisdiction. Although Recorder’s Court handles a

variety of cases, most of the revenue it collects for Chatham County relates to the violation of criminal

violations of the Official Code of Georgia where the fines are established by State laws. The Court

may impose any punishment up to the maximums specified by general law under the limitations on

- 11 -

home rule powers of both county and municipal corporations.

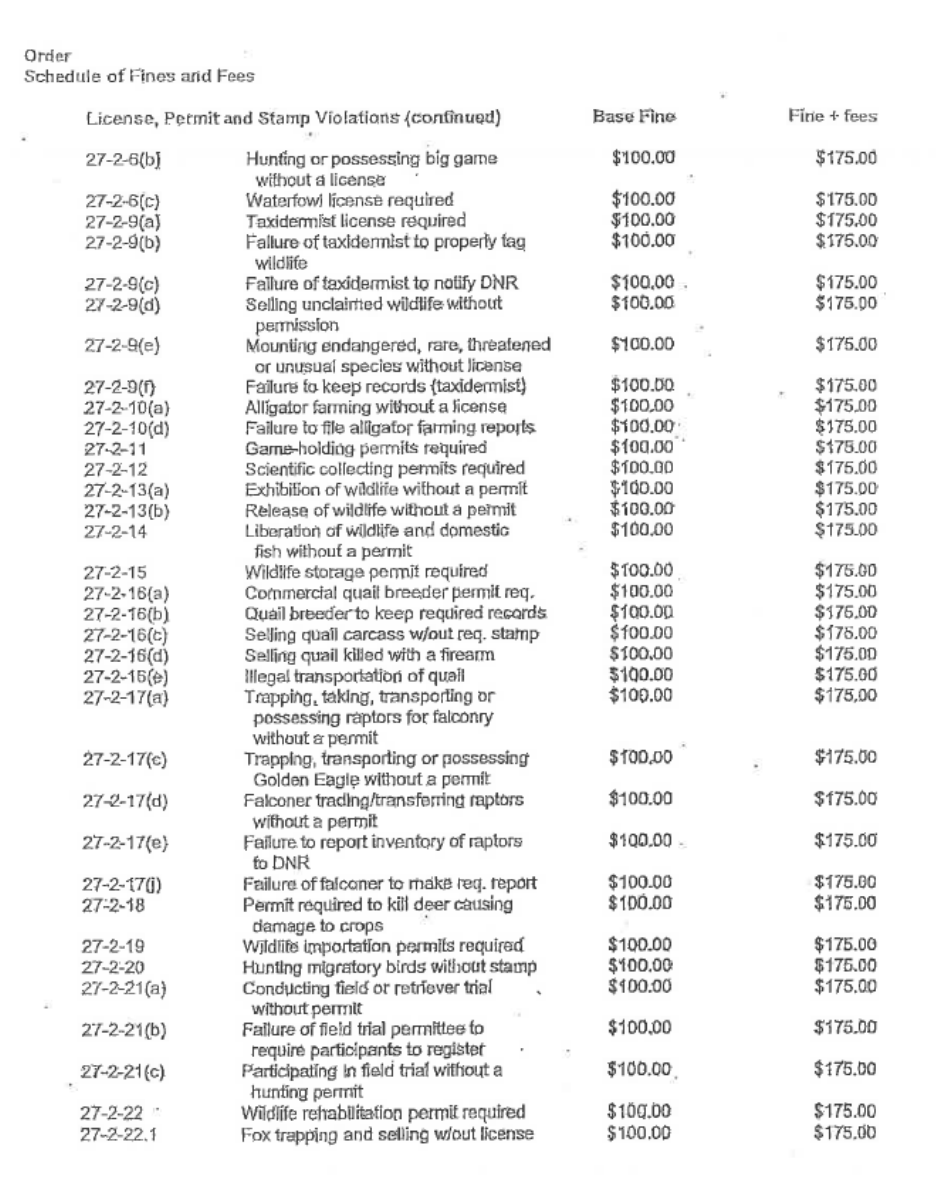

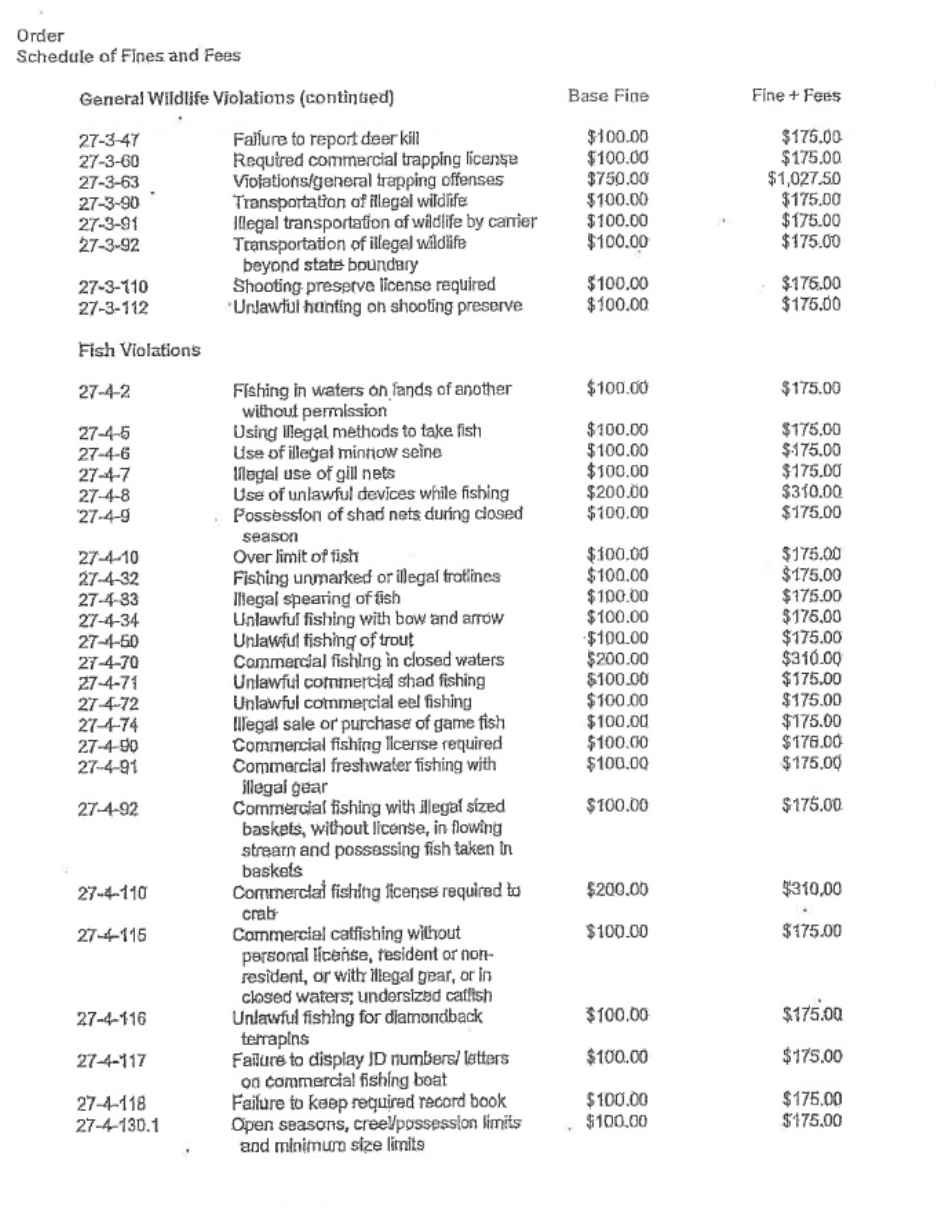

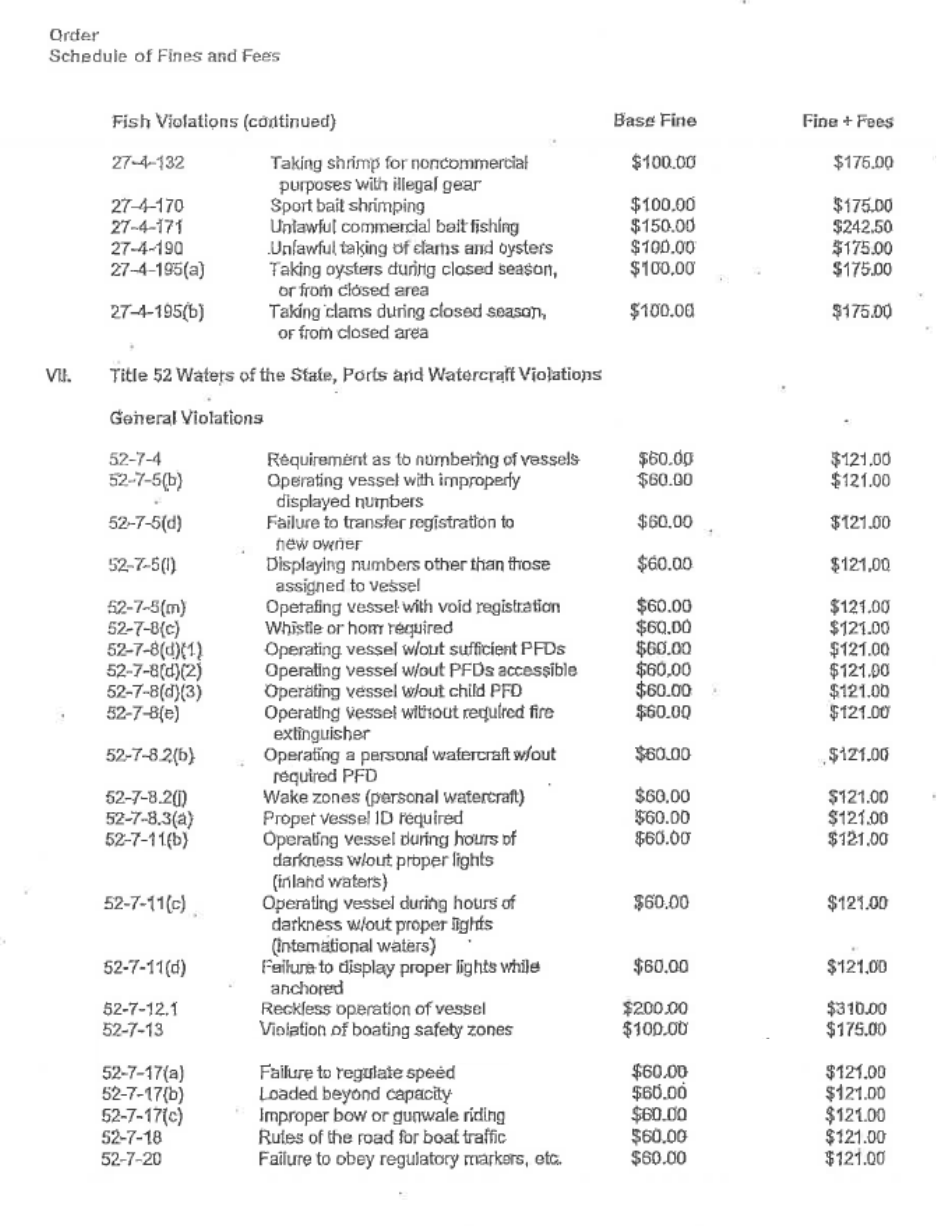

The fee schedule shown in Appendix A contains a list of minimum fines. The fines are exclusive of

costs imposed by legislation, e.g. the Jail Construction and Staffing Act, the Peace Officer,

Prosecutor, and Indigent Defense Funding Act. The addition of other legislative costs will increase

the fine amount.

Article K. Reimbursements

Section 1 County Reimbursements

Chatham County has entered into contractual agreements with various entities to reimburse the

County for certain expenditures.

The most noteworthy of these reimbursements are:

a. Police Overtime Reimbursement - Chatham County submits quarterly invoices to the U.S.

Department of Justice / Drug Enforcement Agency for the time spent by law enforcement

officers.

b. Housing Prisoners Reimbursement - The State of Georgia, Federal Government, and local

municipalities use Chatham County’s detention facility to house prisoners. Chatham County

strives to obtain full cost reimbursement. However, Chatham County is reimbursed at various

rates. Federal and State reimbursements are set by those governments based upon their

legal and budgetary limitations.

c. Law Library Salary Reimbursement - Chatham County pays the salaries of law librarians

through its payroll process. As authorized under Article 36-15-7 of the Official Code of

Georgia Annotated, the Board of Trustees of the law library reimburses Chatham County for

salaries, benefits, and other personnel costs associated with the law librarians.

d. Insurance Reimbursement - When there is an accident involving a County vehicle and

Chatham County is not at fault, proceeds received from the at-fault party are deposited in

this revenue account.

e. Federal Financial Participation - The County receives Federal financial participation under

various grant programs and intergovernmental agreements.

f. Alternate Dispute Resolution Reimbursement - Chatham County receives reimbursement for

this activity’s operational expenditures from the Office of Alternatives Dispute Resolution.

Article L. Land Bank Authority

Section 1 Surplus Property Account

Under action of the Chatham County Board of Commissioners, a Land Bank Authority / Surplus

Property account was established to fund expenditures related to preparing County properties for

transfer to other governments or for private sale. Revenues in the Land Bank Authority account

represent funds from the sale of surplus property or from resources of the property, e.g. timber.

Chatham County received these properties through tax default. Funds under the Land Bank

- 12 -

Authority are expended for several purposes. Funds are used to remove dilapidated structures and

ensure public safety and health of County-owned property. Also the funds are used to pay personnel

for property records research.

Article M. Voter / Election Revenues

Section 1 Fee Established

The County primarily receives two types of voter / election revenues. The first is a candidate

qualifying fee. The second is from the sale of voter lists. Both fees have been established under

Georgia laws.

Section 2 Candidate Qualifying Fees

a. The Chatham County Commissioners, not later than February 1

st

of any year in which a

general primary, nonpartisan primary, or general election is be held, and at least twenty days

(20) days prior to the special primary or election in the case of a special primary or special

election, shall fix and publish a qualifying fee for each County office to be filled in the

upcoming primary or elections. Such fee shall be three percent (3%) of the annual salary of

the office if a salaried office. If not a salaried office, a reasonable fee shall be set by the

County Commissioners, such fee not to exceed three percent (3%) of the income derived

from such office by the person holding the office for the preceding year.

b. Qualifying fees shall be prorated and distributed as follows:

(1) Fees paid to the County political party; fifty percent (50%) to be retained by the

County political party with which the candidate qualified; fifty percent (50%) to be

transmitted to the Superintendent of Elections of Chatham County and then to

Chatham County. Such fees will be applied toward the cost of the primary and

election.

(2) Fees paid to the State political party: Seventy-five percent (75%) to be retained by

the State political party; twenty-five percent (25%) to be transmitted to the Secretary

of State with the party’s certified list of candidates. Such fees shall be transmitted

by the Secretary of

State as follows: one-third (1/3) to the State treasurer and two-thirds (2/3) divided

among the governing authorities of the counties in the candidate’s district in

proportion to the population of each such county according to the U.S. decennial

census, such fees to be applied to the cost of holding the election.

Section 3 Sale of Voter List

The Office of Voter Registration remits funds from the sale of voter lists and electronic files to the

County. Pursuant to O.C.G.A. 21-2-225(c) the Georgia Election Code and the Office of the Secretary

of State, the Chatham County Board of Registrars establishes the following costs for regular voter

registration data effective July 1, 2011 as follows:

Number of Voters Cost – Paper Cost - CD

0 - 10,000 $80.00 $60.00

- 13 -

10,001 - 50,000 $225.00 $130.00

50,001 - 100,000 $450.00 $185.00

100,001 - 200,000 $900.00 $360.00

200,001 - 500,000 $1875.00 $585.00

The charge for voter mailing labels is three cents ($0.03) per name and address.

Article N. Rental Revenue

Section 1 Rental of County Facilities

Under various contractual agreements Chatham County receives rental revenue from governmental

and non-profit entities occupying Chatham County facilities. Tenants include is Recorders Court and

the Chatham County Health Department.

Article O. Other Revenues

Section 1 Payroll Garnishments

The Chatham County Finance Department charges a salary garnishment fee to Chatham County

employees for payroll expenditures associated with court-ordered garnishments. The fee,

established under Georgia law, is fifteen dollars ($15.00) or ten percent (10%) of the amount

garnished, whichever is greater, not to exceed fifty dollars ($50.00).

Section 2 Health Inspections

This fee is charged to municipalities for housing hygiene inspections and enforcement work

performed by the Chatham County Health Department. The fees are set by the Chatham County

Health Department.

Section 3 CSRU Application Fee

The Child Support Recovery Enforcement requires each applicant to pay a twenty five dollar ($25.00)

fee for application processing. The applicants are usually seeking financial assistance for their

children from the other biological parent. The Child Support Recovery Unit operates under State

mandates.

Section 4 Sale of Surplus Personal Property

The Chatham County purchasing ordinance governs the sale of surplus property. The ordinance

states that all sales of obsolete or unusable County personal property shall be sold at public auction

by the Purchasing Agent or his designee. Where there are unique or specialized pieces of personal

property, the purchasing agent may require a competitive sealed bid process.

Section 5 Miscellaneous Revenue

Chatham County receives miscellaneous revenue from a variety of sources. Some of the most

common are:

Photocopy reimbursements - $0.25 per page;

Non-sufficient funds charges - $30.00 or 5% of the face value of the check (whichever is greater) for

any check returned to Chatham County is collectible as a non-sufficient funds charge under Georgia

code;

Refunds from vendors;

- 14 -

Jury checks returned to the County by County employees; and,

Print Shop Revenue.

Section 6 Wireless Telecommunication Facilities Filing Fees

a. Petition Type: For details on petition type see Section 16 of the Wireless Telecommunications

Facilities Ordinance.

b. Base Fee, Engineering Fee, and Study Recovery Fees: Every petition for WTF shall pay the

base fee, engineering fee, and study recovery fee.

c. Third Party Review: Review procedures vary by the type of WTF facility proposed. Where

due to the complexity of the methodology or analysis required to review an application for a

WTF requiring radio frequency analysis, the Executive Director or Planning Commission may

require a technical expert review as described in Section 16 of the Wireless

Telecommunication Facilities Ordinance.

d. “After-the-Fact” Application: Fees for any application for which work has already started or

proceeded prior to obtaining an “Approval”, the fees herein specified shall be doubled, but

the payment of such doubled fees shall not relieve any person from fully complying with the

requirements of the ordinance in the exception of the work nor from any other penalties as

prescribed herein.

Petition Base Engineering Study Third Party

Type Fee Review Fee Recovery Fee Review

Concealed $2,175 Base Fee ($500) + $1,000/ $3,500/If

Attached WTF No. of Acres x Application required

$400/ac (Min. $700)

Collocation or $2,100 Base Fee ($500) + $1,000/ $3,500/If

Combining or No. of Acres x Application required

Modification on $400/ac (Min. $700)

Existing Antenna Support Structure

Attached WTF $2,175 Base Fee ($500) + $1,000/ $3,500/If

No. of Acres x Application required

$400/ac (Min. $700)

Petition Base Engineering Study Third Party

Type Fee Review Fee Recovery Fee Review

Replacement $3,100 Base Fee ($500) + $1,000/ $3,500/If

Of Existing No. of Acres x Application required

Antenna $400/ac (Min. $700)

Support Structure

Concealed $4,075 Base Fee ($500) + $1,000/ $3,500/If

WTF No. of Acres x Application required

- 15 -

$400/ac (Min. $700)

New Non- $5,075 Base Fee ($500) + $1,000/ $3,500/If

Concealed No. of Acres x Application required

Antenna $400/ac (Min. $700)

Support Structure

Temporary $2,100 Base Fee ($500) + $1,000/ $3,500/If

WTF (Cell on No. of Acres x Application required

Wheels) $400/ac (Min. $700)

Section 7 Secondary Metal Recycling Program

Pursuant to O.C.G.A. 10-1-360, beginning July 1, 2012, secondary metals recyclers who purchase

regulated metal property in any quantity must register with the appropriate sheriff’s office. The

registration fee is two hundred dollars ($200.00) and will be collected by the Chatham County

Sheriff’s Office and the entire fee returned to Chatham County.

Section 8 CCPD and Sheriff Off Duty Program

The Chatham County Sheriff’s office will collect the following fees for security services for use of the

Department’s deputies for a minimum of 4 hours.

Uniformed Officer – Regular Days $22/hr

Uniformed Officer – Holiday $30/hr

Uniformed Officer – High risk or hazardous Duty $30/hr

The CCPD will collect fees associated with their Off Duty Program.

Section 9 Short Term Rental

Refer to Chatham County Code Chapter 16, Article IV and Article XIII.

https://www.chathamcountyga.gov/OurCounty/CodeBook

Article P. Parking Garage Fees

Section 1 Parking Fees

Listed below are the monthly, daily, and hourly rates for the Chatham County Parking Garage. All

parking spaces that are prepaid for six months will receive a ten percent (10%) discount.

Parking Garage – 102 MLK Blvd. – Monthly

Reserved Space (Unlimited Access)

County Employees $ 125.00

Non-County Employee $ 250.00

*Limited Reserved Spaces ( These spaces are outside of non-restricted area)

Non-reserved Space (Unlimited Access)

Non-County Employee $ 180.00

- 16 -

Non-reserved Space (Limited Access)

County Employees $ 57.00

Non-County Employee $ 85.00

May be increased if space is used less than 50% during month

Lost or Damaged Cards $ 35.00

Parking Garage - Montgomery Street - Hourly / Daily Rates

Hourly Rate - 1

st

hour $ 1.50

Hourly Rate - 2

nd

thru 6

th

hour $ 1.50

Daily Rate $ 12.00

Weekend (Daily Flat Rate) $ 12.00

Special Events (Rates may vary) $ 25.00 - 35.00

Article Q. Police Administrative Fees

Section 1 Crime Scene Report

The police crime scene report fee is determined by the cost of the service. This fee is charged to

those municipalities and individuals desiring evidence related to a crime such as photographs and

reports, and to cover costs related to time used by Chatham County Police Department in compiling

information related thereto.

Section 2 Fingerprinting Fee

A fingerprint fee of five dollars is charged to fingerprint individuals for such things as immigration,

professional licensing, and day care worker certifications. A fee of five dollars ($5.00) per card is

charged in instances where more than one card is required, i.e. those who are seeking citizenship.

Section 3 Accident Report Fee

Upon request, the Chatham County Police Department will provide the public with a copy of an

accident report. The County is authorized to charge for providing accident reports under the State

of Georgia Code.

Section 4 Parking Citation

Pursuant to Chatham County Code Chapter 12: Motor Vehicles, Roads, Streets and Highways.

Article III and Article IV violations of the parking regulations of the County shall be as follows:

1. Commercial vehicle parking in residential neighborhood $150.00

2. Trailer or semitrailer parking violation $150.00

3. Parking in a no public zone or in public right of way $50.00

4. Double Parking $50.00

5. Improper Parking at a curb $15.00

6. Parking on wrong side of street $10.00

7. Parking on a sidewalk $30.00

8. Parking on a median or greenspace $50.00

9. Parking at a fire hydrant $150.00

10. Parking in a fire zone (inactive) $15.00

- 17 -

11. Parking in a fire zone (active) $500.00

12. Overnight Boat Ramp parking violation $50.00

13. Parked outside of designated spaces at Boat Ramps $15.00

14. Abandoned vehicle at Boat Ramp $150.00

15. Commercial vehicles parked at Boat Ramp for sales without permission $250.00

16. Parking illegally in spaces for persons with disabilities $200.00

Citations paid after (30) days will incur additional fees.

Section 5 Video / Audio Tapes Copying Fee

Fees are determined by the cost of the service unless otherwise governed by Open Records Act.

Section 6 Photo Copying & Enlargement Fee

Fees are determined by the cost of the service unless otherwise governed by

Open Records Act.

Section 7 Records Unit Fees

Fees are determined by the cost of the service unless otherwise governed by

Open Records Act.

Section 8 Animal Control Fees

Chatham County assesses fees for animal control services under the Chatham County Animal Control

Ordinance. All dogs or cats three months of age or older must be vaccinated against rabies and receive a

license tag from Chatham County every twelve months following the initial vaccination. The license tag

should be acquired and paid for within thirty (30) days of annual inoculation. Non-compliance and the

issuance of an ordinance citation shall result in a set fine of:

First Offense

$25.00

Second Offense

$100.00

Third Offense

$150.00 up $500.00

Any person owning a dog or cat that does not comply with this section on multiple occasions shall have an

increased fine as follows:

The veterinarian’s fees for vaccination of a dog or cat shall be set by each individual licensed

veterinarian or the State of Georgia. A license tag will be issued in exchange for a fee as set

forth in the

schedule below, which will be collected by –Animal Services Division from the owner of each dog or

cat that has

received the anti-rabies vaccine and rabies certificate. Veterinarians that opt to sell the tags

shall retain a $1.00 Administrative fee for each tag sold.

Single Animal License (quantity less than 10)

Dog 1 year

$

5.00

Cat 1 year

$

5.00

Dog 3 year

$ 15.00

Cat 3 year

$ 15.00

- 18 -

In addition to license tag fees,

the Animal Control Services charges a thirty-five dollars ($35.00)

impoundment fee when

unrestrained animals are carried to the Animal Services by an Animal Services

Officer. If

two or more animals, which are owned by the same owner, are picked up by Animal Control at

the same time, only one (1) thirty-five dollars ($35.00) impoundment fee is charged. Boarding fee is also

charged for each impounded animal up to twenty-five dollars ($25.00) per day. All animals must be

retrieved

by the owner within three (5) days of impoundment and all necessary and license tag and fees paid prior

to release of animal to the owner. Animal adoption fees for animals adopted through Animal

Services are

seventy dollars ($70.00).

Animal Control Medical Service Fees

Vaccinations:

Caine DHPP $10.00

Canine Bordetella $10.00

Rabies Vaccination $10.00

Feline FVCRP $10.00

Test:

FEL-FIV Test $20.00

FECAL

$20.00

Canine snap heartworm test $20.00

Canine heartworm test direct $20.00

Giardia test $20.00

Parvo Test $20.00

Dewormed:

Ivermec

$ 5.00

Panacur $

20.00

Strongid

$10.00

Albon

$20.00

Surgery:

Feline Spay/Neuter $40.00

Canine Spay/Neuter $75.00

Misc., Medications/Treatments:

Capstar large $10.00

Capstar small $10.00

Feline Revolution $10.00

Pain medication $10.00

Frontline

$10.00

- 19 -

Emergency Medical Services fees as charged by Veterinarian

Impound/Boarding fees:

Impound

$35.00

Boarding per day Up to $

25.00

Rabies Quarantine Up to $30.00

Vet Time (If treatment needed) $50.00 per hour

Service Items:

Microchip

$25.00

Field Sedation $25.00

Health Certificate $25.00

Cat Carrier $15.00

Nail trim $10.00

Medical services fees if claimed by owner:

Medicated Bath $20.00

Medical grooming/shave $30.00

Clip/Clean/Flush/Debride wound $30.00

Fee for Classified dog:

Annual registration (includes 1 warning sign) $150.00

Additional cost per sign $35.00

Disposal and Removal of Dog Excrement

It shall be unlawful for any person who possess harbors or is in charge of any dog not to

immediately

remove excrement deposited by any dog upon the common thoroughfares, streets,

sidewalks, trees, lawns,

playground area parks, squares, and upon other public premises and

the failure to remove said excrement

shall be deemed a public nuisance and is prohibited.

Failure of the person having custody of the dog

to remove the dog excrement by acceptable

device shall constitute a violation and be subject to a fine of

not less than fifty dollars ($50.00)

or greater than two hundred dollars ($200.00).

Dogs Running At-Large

Any person who violates the Restriction on Dogs Running At-Large provision shall, upon

conviction

in the Recorder’s Court of Chatham County or any other court of competent

jurisdiction, be subject

to the following tier of fines:

First Offense

$200.00

Second Offense

$400.00

Third Offense

$800.00

Breeder Fees:

Any dog born that is not AKC registered must be spayed or neutered as soon as medically possible as well

as both parents, if possible. Any breeder of such animal who does not have AKC registration but has been

- 20 -

intentionally breed will pay a super breeder fee for failure to comply. In addition to the super breeder fee of

two hundred fifty dollars ($250) the pet shall come into compliance within 5 days. Upon second conviction,

the super breeder fee shall be one thousand dollars ($1,000).

Article 1 of Chatham County Animal Control Ordinance Penalty:

Any person violating any provisions of this chapter upon conviction before Chatham County Recorder’s Court

of the State Court of Chatham County or such other court of competent jurisdiction, shall be subject to a fine

of not less than one hundred dollars $100 or in excess of one thousand dollars $1,000 for each count and

violation of this ordinance.

To view the Chatham County Animal Control Ordinance online at:

https://animalservices.ChathamCounty.org/Pet-Resorces/Ordinance.

Beekeeping Registration

All beekeepers are required to annually register each apiary with the Chatham County

Department of

Building Safety. The fee for the registration will be twenty-five dollars ($25.00)

per address, regardless of

the number of hives and will be collected by the Chatham County

Building Safety and Regulatory

Services Department. All fees raised by this registration

procedure shall be designated and used for

Animal Control activities.

Promotions

The Director may modify fees to accommodate promotions at the shelter.

Section 9 Confiscated Funds

Chatham County receives confiscated funds under the search and seizure provisions of The Official

Code of Georgia Annotated and under federal statutes. Confiscated funds are collected by the

County when property is seized due to illegal activity. In these instances, the law enforcement

agency initiates condemnation proceedings on seized property through the District Attorney’s Office.

The District Attorney’s Office determines based on the aspects of the case whether the County is

entitled to the property. In cases involving the Drug Enforcement Administration and/or the U.S.

Department of Justice, seized property is sold by the federal agency and a pro-rata portion of the

sale proceeds is remitted to Chatham County. According to federal guidelines on seized and forfeited

properties, such monies are to be used to enhance law enforcement and not to replace the operating

budget of the Department. Another source of confiscated revenue originates from the condemnation

of property involved in illegal fishing activities as defined in the Official Code of Georgia Annotated.

Under these provisions, such property may upon Court order be sold, and the proceeds of the sale,

after reimbursing various seizure costs and court expenditures, will be remitted to the County.

Section 10 False Alarm Service Fees

a. Fees Established: Pursuant to Chatham County Code Section 10-301 thru 10-312, the

following service fees are hereby established to discourage excessive false alarms at any

single location, enhance the safety of officers of the Chatham County Police, protect the lives

and property of the citizens of Chatham County, reduce unnecessary use of public safety

- 21 -

resources, and produce revenues to defray a portion of the costs of responses to false

alarms.

b. Alarm Users Registration Fee: Each alarm system business, as defined in Section 10-302(c)

of the Chatham County Code must provide the Alarm System Coordinator with a listing of

locations that are using an alarm system monitored by said business. This listing must be in

computerized format specified by the Alarm System Coordinator. All locations on this listing

will be considered registered alarm users. Each alarm system business will be responsible

for supplying the Alarm System Coordinator with any changes to its list of registered alarm

users. An annual registration fee of $12.00 per residential alarm user and $24.00 per

commercial alarm user will be collected and remitted at the time of initial registration by the

alarm system business and renewed by July 1st of each year. An alarm company may

choose to file monthly with a due date of the 20

th

of each month. Any household headed by

a person 65 or older, will receive a rebate or waiver of the annual alarm registration fee.

c. False Alarm Fees for Registered Alarm Users: Excessive false alarms for registered alarm

users are considered to be any number in excess of three (3) false alarms during the 12-

month billing cycle; except in the case of a household determined to be eligible for a rebate

or waiver of the alarm registration fee as described above in Section B., in which case the

number shall be four (4) false alarms. Upon the fourth false alarm, an alarm user will be

assessed and billed a fee of $100 for the excessive alarm and notified of suspension as a

registered alarm user. Alarm users suspended from the alarm registry will be considered to

be unregistered alarm users for the purpose of billing false alarms.

d. False Alarm Fees for Unregistered Alarm Users: All false alarm responses to unregistered

locations will be billed to the alarm system user. The first through third false alarms at a

single location within the 12-month billing cycle will be billed at a rate of $100 per false alarm.

The fourth through tenth false alarms at a single location during the same time period will be

billed at $150 per false alarm. The eleventh and all subsequent false alarms during the same

time period will be billed at $200 per false alarm.

e. Notices, Billing and Payment of Fees: A notice will be sent to the alarm user advising of each

occurrence of a false alarm. Statements will be mailed monthly detailing the date of each

false alarm and the fees due. Payment shall be made to the County within thirty (30) days

of the invoice date. In the event of non-payment by a registered user, the Alarm Systems

Coordinator will provide written notification to the alarm system company and the alarm

system user advising that the user has been removed from the alarm system users registry,

possible loss of police response for alarm calls, all false alarm fees must be paid and a

statement must be provided by the alarm system company that the alarm system has been

inspected and that the user has been properly trained on the use of the system. Households

determined to be eligible for a rebate or waiver of the annual alarm registration fee as

described above in Section B for purposes of the ordinance are considered high-risk

households and will not be subject to loss of police response unless the household is

determined to have had in excess of ten false alarms in a billing cycle. All fees for excessive

false alarms at unregistered locations shall be billed at least monthly to the property owner.

All fees for false alarm responses caused by failure of an alarm system business to notify

police in advance of performing maintenance to an alarm system will be billed to the alarm

system business. All such false alarms will be billed at a rate of $100 per false alarm at least

- 22 -

monthly.

f. Permit Required for Alarm Systems Businesses; Fee Established: Pursuant to Chatham

County Code Section 10-304, all businesses engaged in or seeking to engage in an alarm

system business shall make application to Chatham County for a permit to operate said

business and shall pay a permit fee of $100. This fee is due annually on July 1

st

of each

year. Permit fees paid after of July 1

st

will result in a 10% penalty. The application for this

permit shall be on a form provided by Chatham County. Failure to comply and pay the fee

will subject the business to the enforcement of Chatham County as referenced in Chatham

County Code Chapter 16-113.

Section 11 Automated Traffic Enforcement Safety Devices in School Zones:

Any person who shall violate any provision of this Article shall be subject to the civil penalties

set forth at O.C.G.A. § 40-14-18(b)(1), as amended, including a fine in the amount of $75 for

a first violation and $125 for a second or any subsequent violation, in addition to fees

associated with the electronic processing of such civil monetary penalty which shall not

exceed $25.

Article R. Engineering Fees

Section 1 Land Disturbing Activity Fees

a. Single Family Residential Land Disturbing Activities Permit: Four hundred fifty dollars

($450.00) per lot.

b. Other than Single Family Residential Land Disturbing Activities Development Permit: Three

thousand dollars ($3,000) base charge, plus one thousand dollars ($1,000) per disturbed

acre or any pro-rated portion thereof. The total Land Disturbing Activity (LDA) fee cannot

exceed sixteen thousand dollars ($30,000).

c. Other than Single Family Residential Land Disturbing Activities Clearing and/or Grading

Permit: Two thousand dollars ($2,000) base charge, plus five hundred dollars ($500) per

disturbed acre or any pro-rated portion thereof.

d. Failure to Obtain a Permit: Where land disturbing activities for which a permit is required are

started or proceeded with prior to issuance of said permit, the fees herein specified shall be

doubled. The payment of such doubled fees shall not relieve any persons from fully

complying with the requirements of this code nor from any other penalties as prescribed.

e. Arborist Residential Plot Plan Review for individual lots: Fifty dollars ($50.00) per lot.

f Arborist Lot Tree Re-Inspection: Fifty dollars ($50.00) per inspection, required

to be paid prior to scheduling 2nd inspection and each subsequent inspection.

g Plan Re-review: 25% of original fee, required to be paid prior to starting 4

th

review and each subsequent review.

- 23 -

h Changes to Approved plans (if requested by the applicant prior to field

implementation of the proposed changes): 25% of original fee.

i Changes to Approved plans (if requested by the applicant after field

implementation of the proposed changes): 50% of original fee.

j Re-Inspections: Two hundred dollars ($200.00) per inspection, required to be

paid prior to scheduling re-inspection of a previously failed inspection.

k. National Pollutant Discharge Elimination System (NPDES) Fees: Forty dollars ($40.00) per

acre.

l. Bond Processing Fee: Two hundred dollars ($200.00) per bond, required to be paid prior to

the completion of the final inspection. The total Bond Processing fee cannot exceed five

hundred dollars ($500.00) for the project that was permitted.

Section 2 Other Engineering Fees

a. Residential Water and/or Sewer Plan Review (only developments on County water and/or

sewer located inside municipalities): Eighty dollars ($80.00) per lot.

b. Commercial and Multi-family Water and/or Sewer Plan Review (only development on County

water and/or sewer located inside municipalities): Two hundred dollars ($200.00) base