315 King St W, PO Box 640 Chatham ON N7M 5K8

Tel: 519-360-1998 Fax: 519-358-4534

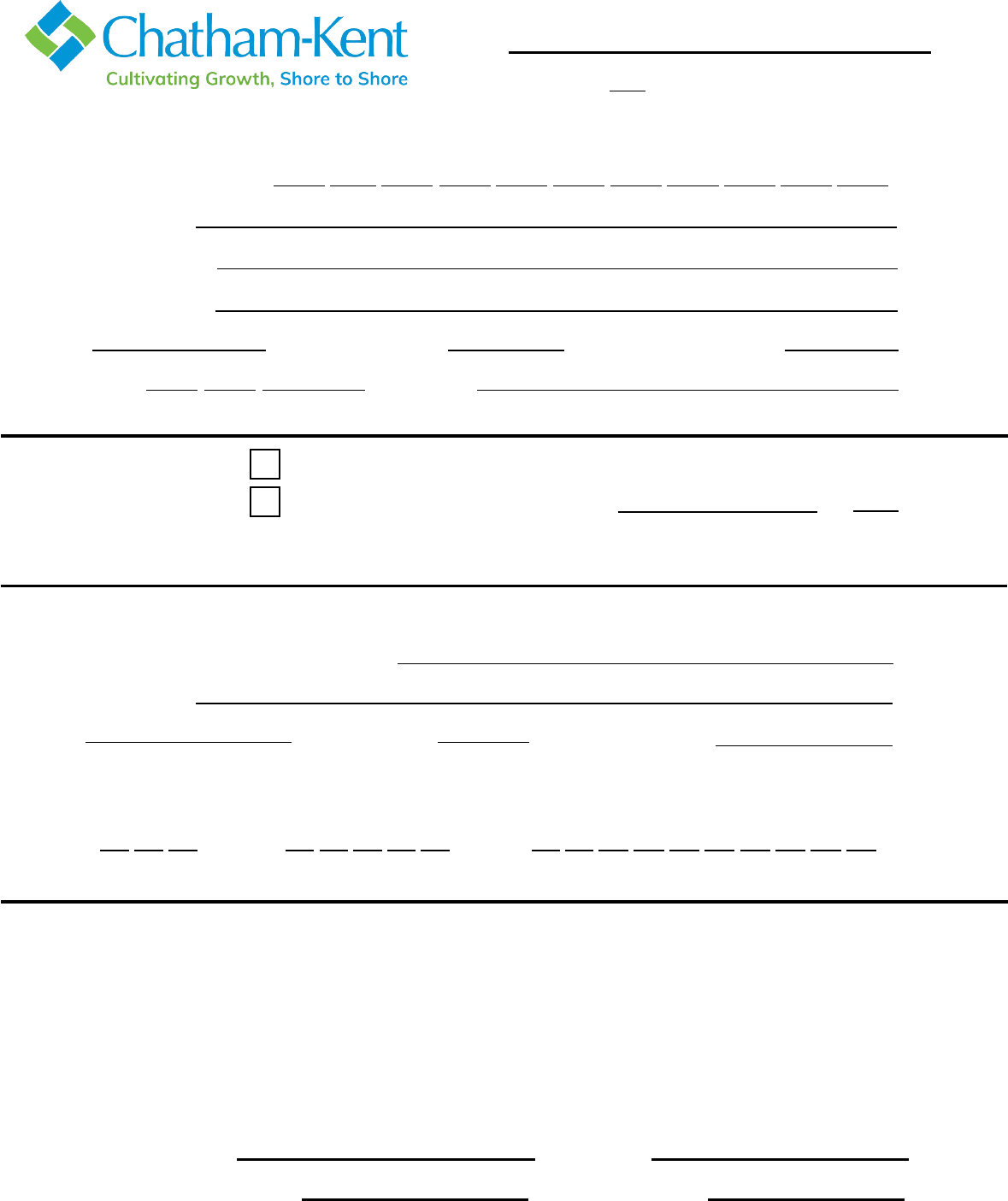

PROPERTY TAX

Pre-Authorized Payment Agreement

All arrears must be paid in full prior to implementation

Roll Number: 3 6 5 0 - | | - | | - | | | |

Civic Address:

Customer Name:

Mailing Address:

City: Province: Postal Code:

Phone #: ( ) - Email:

Payment Type:

Due Date - As indicated on Municipal Tax Bill

Monthly (15

th

) starting the month of:

, 20

Return the Agreement and

a VOID cheque 10 days prior to your first payment to one of our offices, or by email

to [email protected] or by mail to Attention: Accounts Receivable Department

Payment Information: *Attach a VOID Cheque to this agreement

Name of Canadian Financial Institution:

Branch Address:

City: Province:

Postal Code:

Please note, we are unable to accept Line of Credit bank accounts for the PAP plan.

| | | | | | | | | | | | | | |

Bank # Transit # Account #

I/We (the above named customer) authorize the Municipality of Chatham-Kent to debit my/our account on the due date, or if

monthly plan, on the 15th day of the month.

I/We understand that supplementary billings will be my/our responsibility, as they are not covered by this plan.

I/We will notify the Municipality 10 days in advance of payment date if I/We wish to start, end, move my/our bank account or

make other changes to the account. Each payment shall be the same as if I/We had personally issued a cheque authorizing the

bank as indicated and to debit the amount specified from my/our account.

Please note, returned payments are subject to the addition of an administration fee. If a returned payment is not replaced

within thirty days, participation in the pre-authorized payment plan will be ceased. Two returned payments within a one year

period will result in the termination of your participation in the plan. A new application may be submitted after a one year

waiting period. A completed form is required for each property that is to be enrolled in the plan.

Customer Signature:

Date:

Customer Signature (if required):

Representative:

Where a facsimile number or e-mail is provided within this document, when transmitted electronically to a facsimile or email address, the signature(s) of

the party shall then be deemed as an original signature. The Municipality collects and uses the personal information you provide on this form in conformance

with

the Municipal Freedom of Information and Protection of Privacy Act R.S.O. 1990, c.M. 56. The Municipality will only disclose your information in

conformance with that Act.

- 0 0 0 0

Mailing address and contact information provided will replace any existing contact information for all tax related matters on this account.

Pre-Authorized Payment Agreement

You have the option of selecting one of the two different pre-authorized payment plans that

offer you the convenience of having no cheques to write, no worries about overdue payments,

no large lump sum payments, and no line-ups at your bank or municipal office.

Your two pre-authorized payment options include:

1. Instalment (Due Date)

You can select to pay your taxes on instalment due date. All arrears MUST be paid in full prior

to implementation. You may then apply to have the instalment amounts withdrawn from

your bank account. There is no service fee for enrolling in this plan.

Supplementary Tax billings will be your responsibility, as they will not be covered under this

program.

2. Monthly

An automatic withdrawal of a system calculated amount will be removed from your bank

account on the fifteenth day of each month. All arrears MUST be paid in full prior

to implementation. You may then apply to have the monthly amounts withdrawn from your

bank account. Monthly pre-authorized payment plans will be recalculated twice per year,

in February and July, to align with the interim and final tax bills. The calculated

withdrawal amounts will be populated in a payment schedule on the Tax Bill for your

reference. Please note, the January monthly withdrawal amount will be a continuation of

the July to December calculated amount. There is no service fee for enrollment in this

plan. Supplementary Tax billings will be your responsibility, as they will not be covered under

this program. Adjustments DO NOT affect this plan until bill re-calculation. If you wish to have

your amount revised, please submit a written request to the tax department.

If you are not currently enrolled in the Pre-authorized Payment Plan for the payment

of taxes you must complete a Pre-Authorized Payment Agreement Form for each

property you wish to enroll in the plan and return it along with a VOID cheque to the

Accounts Receivable Department. This authorization will not be required each year. To

make banking changes or withdraw from a plan you must provide ten days (10) written notice

to the Accounts Receivable Department in advance of the payment date.

To Change or Cancel your Pre-Authorized Payment information please visit our website at

www.chatham-kent.ca or visit one of our municipal service centres and complete the required

form for each property that is affected by the change.